jersey city property tax assessment

Property taxes are the major source of funds for Jersey City and the rest of local governmental entities. For the past 4 years Ive been researching and writing about property taxes and revaluation among other topics on CivicParent.

/GettyImages-1042505068-d5c7b095f4704a5286a5cabcc25f4495.jpg)

Your Property Tax Assessment What Does It Mean

Online Inquiry Payment.

. Eduardo CToloza CTA City Assessor. Remember to have your propertys Tax ID Number or Parcel Number available when you call. TAXES BILL 000 000 1000 0 000 2035 1.

189 of home value. Under Search Criteria type in either. Generate Reports Mailing Labels - Maps Include.

HOME HUDSON COUNTY. Your account will remain at the 18 threshold until it is brought current. NJ Property Tax Records In Jersey City NJ.

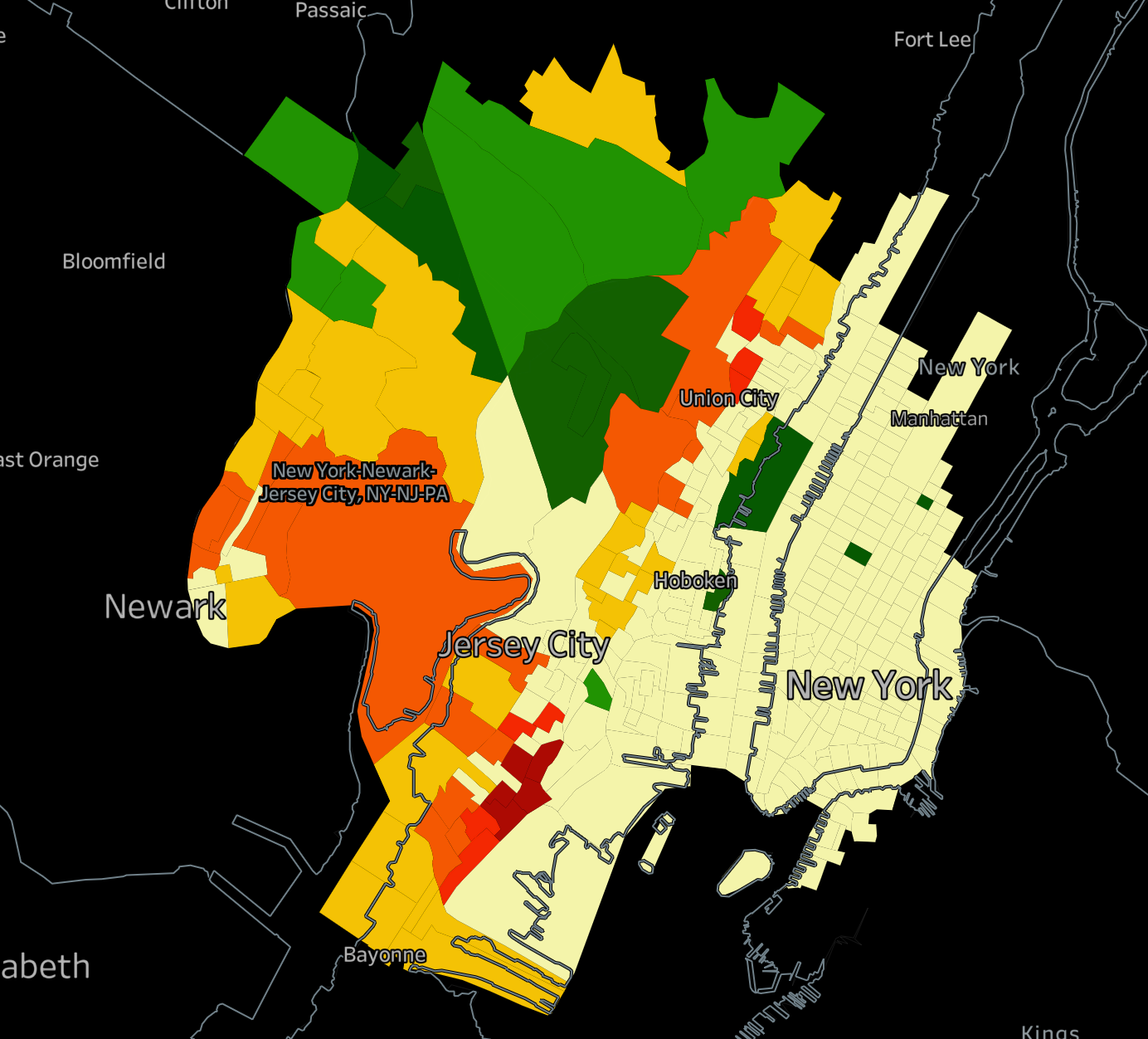

Jersey City last conducted a citywide revaluation its first in 30 years in 2018. By Mail - Check or money order to. New Jerseys real property tax is an ad valorem tax or a tax according to value.

A driving factor is the market growth of Jersey Citys taxable real estate. Under Tax Records Search select Hudson County and Jersey City. Online Inquiry Payment.

NJ Property Tax Records Search Search - NJ Tax Maps Property Records Ownership Assessment Data Real Estate Info Sales History Comparable Properties. But property tax data published in October 2019 by the NJ Division of Taxation reveals Jersey City may once again be approaching the need for another revaluation. Street Address Owner Block Lot Qual Class.

City of Jersey City. All real property is assessed according to the same standard of value except for qualified agricultural or horticultural land. City of Jersey City PO.

If you have documents to send you can fax them to the City of Jersey City assessors office at 201-547-4949. Online Inquiry Payment. The main function of the Tax Assessors Office is the appraisal and evaluation of all land and buildings within the municipality for tax purposes according to state statutes.

King Drive 3rd floor Jersey City NJ 07305 email protected Edward Toloza CTA City Tax Assesor. The standard measure of property value is true value or market value that is what a willing. TAXES BILL 000 0 000 2022 3.

Additional duties include maintaining property transfers keeping current ownership updated checking building permits that have been issued and maintaining. Free service which allows you to look up Jersey City NJ property tax assessment records for any property in Jersey City NJ Pg. REQUEST FOR 200 PROPERTY OWNERS LIST Miscellaneous Payments.

11605 00001 Principal. Public Property Records provide information on land homes and commercial properties in Jersey including titles property deeds mortgages property tax assessment records and other documents. City of Jersey City.

Ad View County Assessor Records Online to Find the Property Taxes on Any Address. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. On June 5th I.

14507 00001 C1806 Principal. 2020-2022 Agendas Minutes and Ordinances. New Jersey has one of the highest average property tax rates.

Jersey City NJ 07302 Tel. NJ law states that property should be assessed. Online Inquiry Payment.

A Jersey Property Records Search locates real estate documents related to property in Jersey New Jersey. General Property Tax Information. Interest in the amount of 8 per annum is charged on the first 150000 of delinquency and 18 per annum on the amount over 150000.

Like Monmouth County Tax Board Tax Records. Left click on Records Search. In the past year Ive also written about tax appeals and I also served on a team of Jersey City Together volunteers in 2017 that helped over 30 residents save over 40000 in tax expense through successful appeals.

Look up Property Assessments Tax Assessment Post Cards. ACH Direct Debits do not incur a fee. 2019 Agendas Minutes Ordinances.

Office of the City Assessor City Hall Annex 364 ML. 11 rows City of Jersey City. ACH Direct Debit Application.

Account Number Block Lot Qualifier Property Location 683385 10901 0003701 63-67 HENRY ST. Jersey City Property tax payments received after the grace period interest will be charged. Find Jersey Online Property Assessment Info From 2022.

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Please call the assessors office in Jersey City before. In Person - The Tax Collectors office is open 830 am.

Instructions on How to Appeal Your Property Value. TO VIEW PROPERTY TAX ASSESSMENTS. To search for tax information you may search by the 10 digit parcel number last name of property owner or site address.

TO VIEW PROPERTY TAX ASSESSMENTS. When searching choose only one of the listed criteria. Tax amount varies by county.

City of Jersey City. Checking Account Debit - Download complete and send the automated clearing house ACH Tax Form to JC Tax Collector 280 Grove Street. Jersey County Property Tax Inquiry.

Several government offices in Jersey and New. You can call the City of Jersey City Tax Assessors Office for assistance at 201-547-5132. Tax Zoning Flood Aerial GIS and more.

Annual Year Income Statement for qualifying Seniors PD 65. 515 S FLOWER ST 49TH FL Bank Code. NJ Tax Records Search Legal Redact My Information.

99 HUDSON ST 1806 Bank Code. JERSEY CITY NJ 07302 Deductions. TAXES BILL 000 0 000 2022 2.

Displaying properties 1 - 150 of 83058 in total. Box 2025 Jersey City NJ 07303. Do not enter information in all the fields.

Besides counties and districts such as hospitals numerous special districts like water and sewer treatment plants as well as parks and recreation facilities depend on tax money. To view Jersey City Tax Rates and Ratios read more here.

Jersey City S Property Tax Rate Finalized At 1 48 Jersey Digs

How Tax Assessments Are Racist Planetizen News

Jersey City Officials Say They Can T Help Soften Blow For School District S Massive Tax Hike Nj Com

How The Mayor Stuck Wards A B C And D With 143 Million In Taxes

Township Of Nutley New Jersey Property Tax Calculator

Your Property Tax Assessment What Does It Mean

New Jersey Extends Property Tax Deadlines Ke Andrews

Township Of Nutley New Jersey Property Tax Calculator

Jersey City New Jersey Property Tax Revaluation 2016 Ballotpedia

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

The Official Website Of City Of Union City Nj Tax Department

How The Mayor Stuck Wards A B C And D With 143 Million In Taxes

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com

How The Mayor Stuck Wards A B C And D With 143 Million In Taxes

New Jersey Business Personal Property Tax A Guide

How To Appeal Property Taxes And Win Over The Appraiser We Did Nj Com